missouri vendor no tax due certificate

The legal business name and MO EIN number must be PREPRINTED on the document by the MO. Missouri Department Of Revenue document.

How To Register For A Sales Tax Permit In Missouri Taxvalet

Missouri vendor no tax due certificate.

. Conflict of Interest -. A Certificate of No Tax Due is NOT sufficient. Has a valid registration with the.

If you need. The vendor no tax due letter is not acceptable for this item. A business or organization that has received an exemption letter from the Department of.

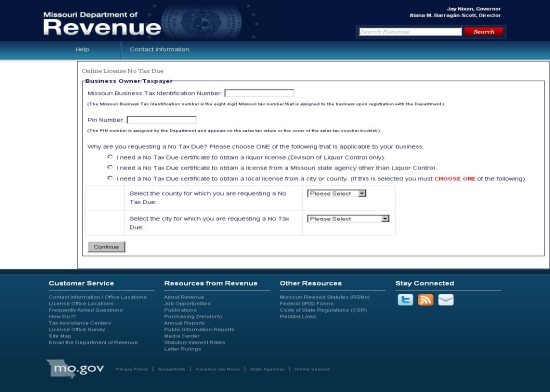

If you need a No Tax Due. A Certificate of Tax Clearance covers corporate income tax sales tax withholding tax and employment security tax. Please enter your MOID and PIN below in order to obtain a statement of No Tax Due.

If you do not provide the Vendor No Tax Due certificate andor maintain a compliant tax status it may render your company unacceptable for further. Tax Clearance please fill out a Request for Tax. R Business License r Liquor License r Other if not listed _____ 4.

More significantly it serves as a safe harbor under the. On a 1000 tax bill these penalties are 100. SalesUse Tax - section 340407 RSMo Missouri statute regarding salesuse tax payments required of vendors by the state.

Current vendor no tax due letter from the missouri. R business license r liquor license r other if not listed 4. The Missouri Department of Revenue will issue a Vendor No Tax Due when a business is properly registered and has all of its salesuse tax paid in full.

A Missouri Tax Clearance Certificate is a Certificate stating that a MO Corporation LLC or Nonprofit has no tax due to the Missouri Department of Revenue. A business or organization that has. I require a sales or use tax.

If taxes are due depending on the. My attention at 660-543-8345. Information available at httpdormogovforms943pdf.

The state of Missouri provides you a vendor no tax due certificate if you do not provide taxable services or sell tangible personal property at retail. Select all that apply. I require a sales or use tax certificate of.

I require a sales or use tax Certificate of No Tax Due for the following. If you need a No Tax Due Certificate for any other reason you can contact the Tax Clearance Unit at 573 751-9268. Missouri statutes pertaining to procurement.

Sales Tax Laws By State Ultimate Guide For Business Owners

How To Form An Llc Advantages Disadvantages Wolters Kluwer

Sales Taxes In The United States Wikipedia

Missouri Sales Use Tax Guide Avalara

Certificate Of Tax Clearance Vs Certificate Of No Tax Due

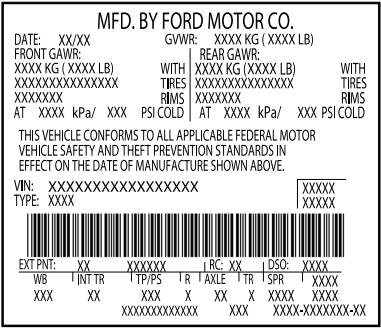

What Is The Door Jamb Safety Compliance Certification Label

3 10 72 Receiving Extracting And Sorting Internal Revenue Service

Missouri Liquor Control Information Alcohol License Laws

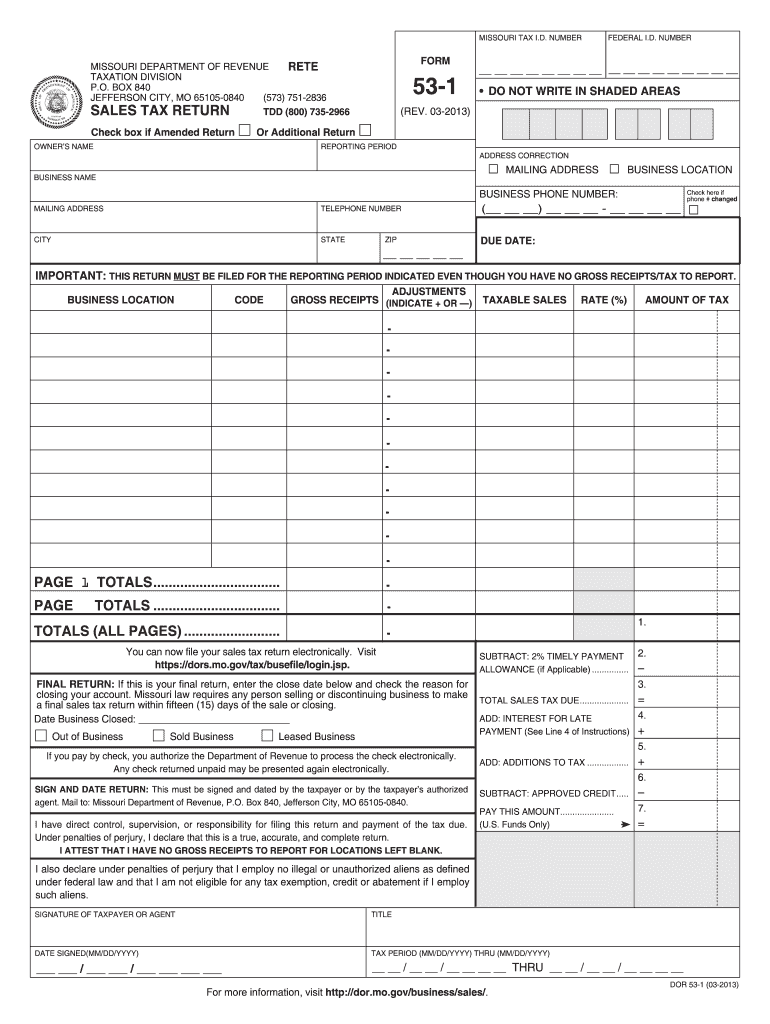

Missouri Sales Tax Form 53 1 Instruction 2011 Fill Out Sign Online Dochub

Missouri Sales Tax Guide For Businesses

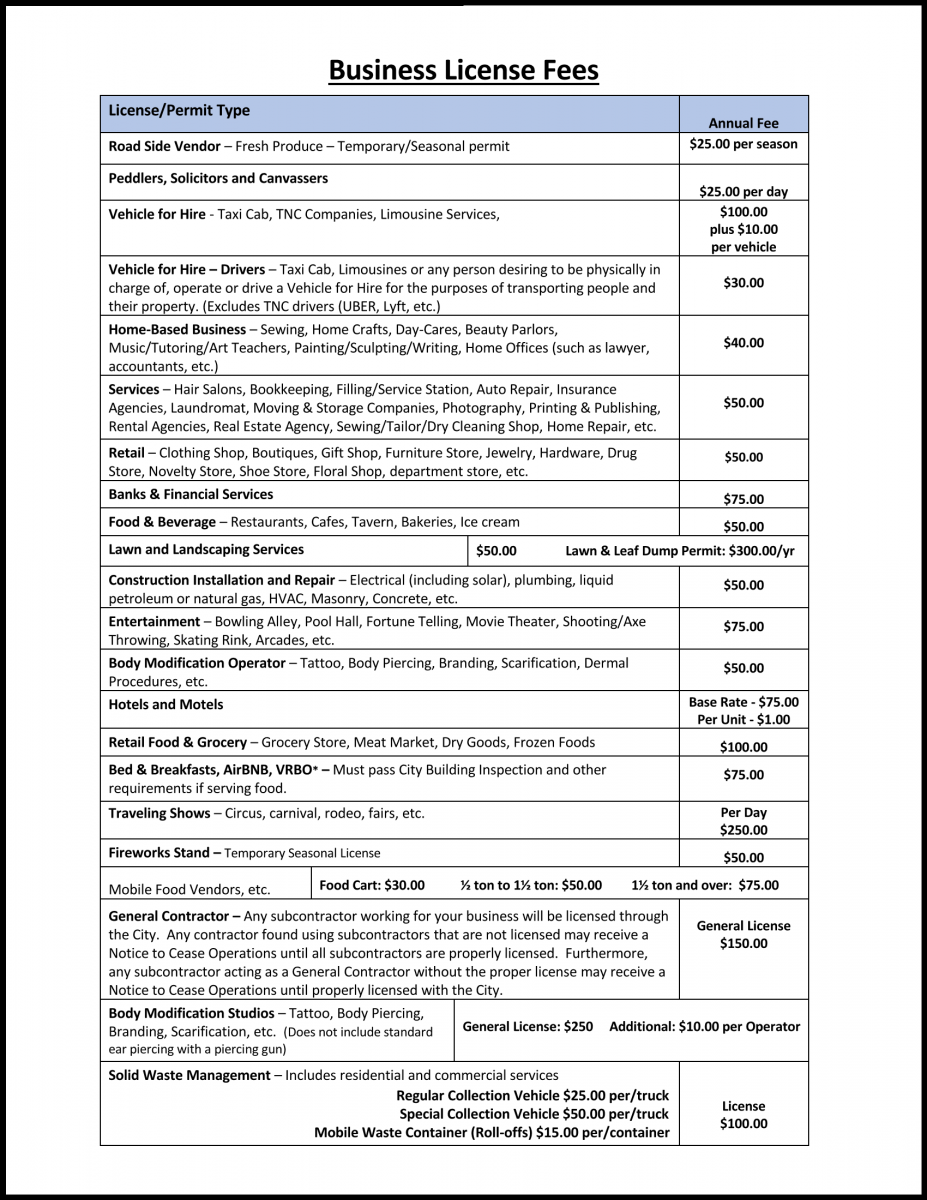

Business Licensing Permitting City Of Waynesville Missouri

Missouri Vendor Use Tax Return Fill In Fill Out Sign Online Dochub

Missouri Requires Out Of State Sellers And Marketplaces To Collect Sales Tax That S A Wrap

A Complete Guide To Sales Tax Exemptions And Exemption Certificate Management